By Anthony Broadman

The Association for Convenience and Fuel Retailing (NACS) again attacked tribal tobacco today, this time before the U.S. Senate Committee on Finance. A long time enemy of legitimate tribal tobacco businesses, the convenience store lobbying group continued to parrot the arguments of big tobacco and attempted to fundamentally mislead the Committee in a statement today.

NACS, part of the “deadly alliance” between convenience stores and big tobacco, has an enormous dog in the tribal tobacco tax fight. Sales of tribal tobacco undercut the roughly $260-billion in sales of tobacco at NACS constituent stores. But what is more sinister is that NACS is using federal and state political pressure to carry its water in what amounts to anti-competitive marketing campaign. Even worse, it’s using misinformation to do so.

NACS's arguments parrot those espoused in the summer of 2011 by Altria, parent company of Philip Morris USA, in an attack on New York tribal smoke shops. Today, NACS claims:

Many Native American tribes and tribal retailers are abusing their sovereignty to evade state taxes on sales of tobacco. Such tribes and retailers abuse their ability to sell tax-free to their own members and expand those sales to non-members even though the Supreme Court has said states can tax tribal sales to non-members.

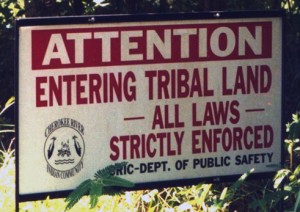

The Department of Justice disabused Philip Morris and the rest of Big Tobacco of this blanket statement 15 years ago; tribal tobacco is not “abusing” sovereignty. States simply lack jurisdiction to interfere with Tribal economic activity when it involves “value generated on the reservations by activities involving the Tribe.” New Mexico v. Mescalero Apache Tribe, 462 U.S. 324, 340. (1983) citing Washington v. Confederated Tribes of Colville Indian Reservation, 447 U.S. 134 (1980).

In Washington State, as throughout Indian Country, federal law generally bars taxes on products that incorporate “value generated on the reservation,” sold to Indians or non-Indians. See WAC 458-20-192(c). In other words, if a Tribe adds value to a product and sells it on the Reservation, it shouldn’t be taxed. The blanket claim that all sales of tribal tobacco are taxable is incorrect, and irresponsible. If NACS wants a level playing field as it claims, it should at least correctly state the law. It can start by letting Tribes decide how to exercise their Tribal sovereignty—not Big Tobacco lobbyists.

NACS argues further:

Native American tribes have immunity from lawsuits in U.S. courts. This immunity is greater than the immunity granted to the United States or foreign governments – all of which can be sued when they act in a commercial rather than a governmental capacity. Tribes have used this unprecedented immunity as a tool to block state efforts to enforce their tax laws. While the federal government can enforce its laws against tribes, states simply cannot.

Stop us if you’ve heard this one before. Which you should have already, because these are exactly the sky-is-falling claims Altria made in 2011 when it argued “Native American Cigarettes Are Not Entitled to ‘Supersovereign’ Immunity.” Tribal tobacco is regulated by the entities that have authority to do so: the United States and Tribal Governments. Framing the issue as though Tribes are “block[ing] state efforts to enforce their tax laws” turns basic notions of Tribal Sovereignty on their head.

Tribes are not blocking legitimate state regulatory incursion; in protecting tribal tobacco from illegal state regulation, Tribes are simply enforcing the very component of federal law that NACS so fears: “While the federal government can enforce its laws against tribes, states simply cannot.” That much is right, NACS.

And instead of honoring that fundamental premise of our federalist system, these convenience store lobbyists ask the Senate to prevent tribes from “us[ing] the cover of their sovereignty” to do business and claim “[t]his is a problem that must be dealt with[.]” In addition to these veiled requests for an abrogation of Tribal sovereign immunity, NACS wants the United States to limit sovereign immunity for newly recognized Tribes, presumably so that states can sue other Tribes over illegal state tobacco taxes.

NACS should be held to the facts, even when it’s inconvenient.

Anthony Broadman is a partner at Galanda Broadman PLLC. He can be reached at 206.321.2672, anthony@galandabroadman.com, or via www.galandabroadman.com.