By Anthony Broadman

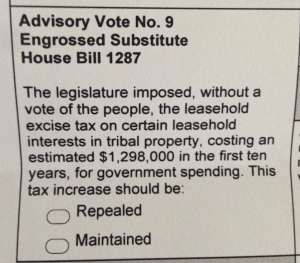

Thanks to Tim Eyman, recent Washington State Indian tax legislation is subject to a non-binding advisory vote. This year, an Eyman advisory vote dealing with “a leasehold excise tax on certain leasehold interests in tribal property,” per HB 1287, has caused much voter confusion.

Governor Inslee signed HB 1287 this spring. According to the published bill summary, the new law:

- Exempts a leasehold interest in property owned by a federally recognized Indian tribe from state property taxation.

- Extends the state leasehold excise tax to a private leasehold interest in property owned by a federally recognized Indian tribe.

- Recognizes economic development as an essential government service for purposes of qualifying tribally owned property for state tax exemption.

HB 1287 Bill Analysis. Eyman’s advisory only, and deceivingly, contemplates the second bullet.

In all, the new law puts tribes on equal footing with other governments as to land used for economic development. The new law exempts such tribally owned fee land from state taxation, yet with the potential for in-lieu payments or leasehold excise taxes between tribes and the state. The new law is good for the State of Washington.

These Eyman “push polls” that are aimed at influencing, if not outright manipulating, voters are a waste of ballot space and election-related taxpayer dollars.  Advisory Vote No. 9 deliberately mixes two perennially controversial issues in Washington: Indians and taxes. Although its description on the ballot leads our state’s voters—be they pro- or anti-tribal, or card-carrying liberals or Tea Partiers—to guess their vote, the outcome could be construed as a referendum on Indian tax policy in Washington State.

Advisory Vote No. 9 deliberately mixes two perennially controversial issues in Washington: Indians and taxes. Although its description on the ballot leads our state’s voters—be they pro- or anti-tribal, or card-carrying liberals or Tea Partiers—to guess their vote, the outcome could be construed as a referendum on Indian tax policy in Washington State.

HB 1287 encourages tribal economic development and job creation and should be “maintained.”

Check the “maintain” box on Advisory Vote No. 9.

Anthony Broadman is a partner at Galanda Broadman PLLC. He can be reached at 206.321.2672, anthony@galandabroadman.com, or via www.galandabroadman.com.